Germany's economy may be showing signs of optimism. The ZEW Indicator of Economic Sentiment for Germany gained 7.3 points to 0.5 in August 2016 from -6.8 in July, but below market consensus of 2. Economic sentiment has partly recovered from the Brexit shock while political risks within and outside the European Union continued to inhibit a more optimistic economic outlook for Germany. Furthermore, uncertainty about the resilience of the EU banking sector persists. Meanwhile, the assessment of the current situation rose sharply to 57.6 from 49.8 in the previous month while economists had forecast the index to increase to 50.

"The ZEW Indicator of Economic Sentiment has partly recovered from the Brexit shock," ZEW-President Achim Wambach, said.

"Political risks within and outside the European Union, however, continue to inhibit a more optimistic economic outlook for Germany. Furthermore, uncertainty about the resilience of the EU banking sector persists," Wambach added.

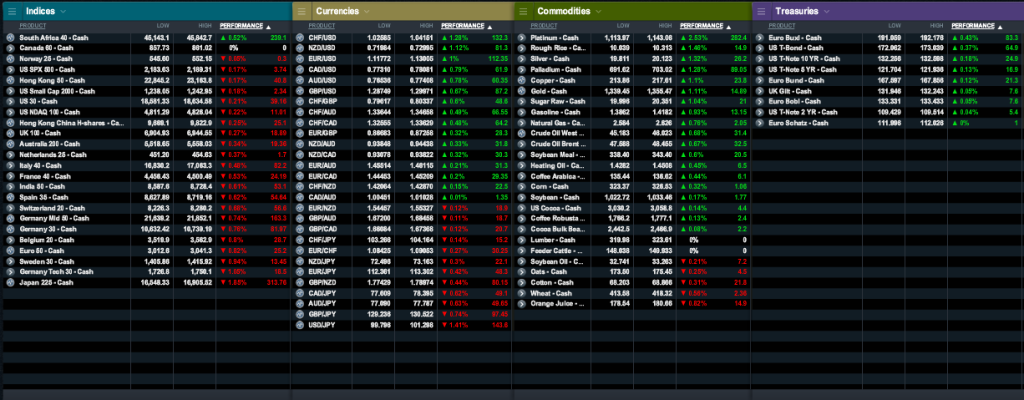

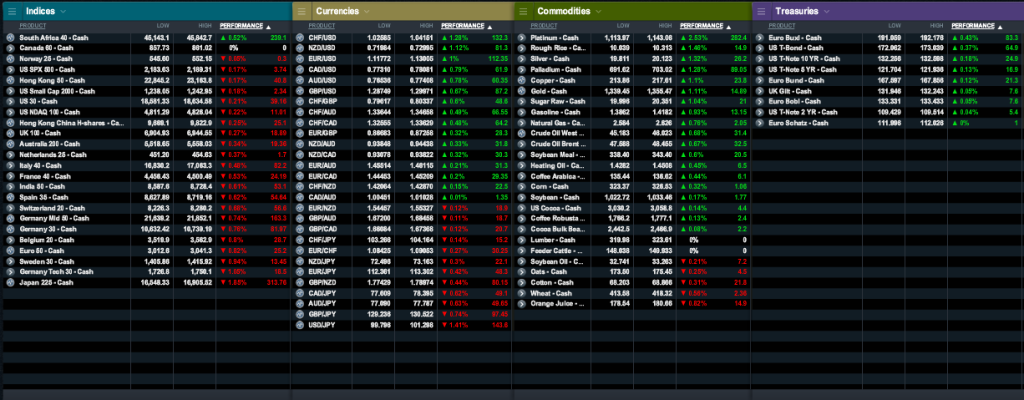

Market Snap

Opening Wrap

In Asian Equity Markets

Opening Wrap

In Asian Equity Markets stocks rose to one-year highs, expanding their gains this year to almost 10 percent, supported by a jump in oil prices and investor expectations of an extended phase of easy monetary policy around the globe. MSCI's broadest index of Asia-Pacific stocks outside Japan edged up 0.1 percent, bringing its gains so far this year to 9.8 percent. The Nikkei fell 0.2 percent to 16,837.98 in midmorning trade. The broader Topix shed 0.1 percent to 1,315.94 and the JPX-Nikkei Index 400 lost 0.1 percent to 11,839.00. The Australian index, S&P/ASX, fell 0.31 percent, while the Shanghai Composite Index eased 0.33 percent.

In Currency Markets the dollar hit a one-month low against the yen on Tuesday, staying on the defensive after recent U.S. economic data were seen likely to limit the prospects of a near-term Fed interest rate hike. The dollar fell 0.8 percent to 100.43 yen and touched a low of 100.355 yen at one point, the greenback's lowest level against the yen in more than a month. The euro edged up 0.1 percent to $1.1195. Against the yen, the euro lost 0.7 percent to 112.45 yen. The Canadian dollar was at C$1.2914 per U.S. dollar after touching a one-month high of C$1.2902 on Monday. The Australian dollar inched up 0.1 percent to $0.7683 after gaining 0.4 percent on Monday.

In Commodities Markets oil prices edged away from 5-week highs on Tuesday, with traders cashing in on a 16-percent rally since early August that has largely been fueled by talk of producers taking action to prop up the market. International Brent crude oil futures were trading at $48.14 per barrel, down 21 cents from their previous close. U.S. West Texas Intermediate crude was trading at $45.56 a barrel, down 18 cents from its previous close. Spot gold was up about 0.6 percent at $1,346.31 an ounce. Silver was up 0.6 percent at $19.91 an ounce. Platinum, which hit a near three-week low of $1,105.50 earlier in the session, was up 1.4 percent at $1,122.80. Palladium was up about 0.5 percent at $696.70.

In US Equity Markets stocks closed at record highs on Monday, boosted by expectations for continued monetary policy easing around the globe and a jump in oil prices to nearly five-week highs on speculation top producers may be open to cutting output. The Dow Jones industrial average ended up 0.32 percent, at 18,636.05. The S&P 500 gained 0.28 percent, to 2,190.15 and the Nasdaq Composite added 0.56 percent, to 5,262.02. Post Properties gained 9.4 percent after the company agreed to be bought by Mid-America Apartment Communities for about $3.88 billion. Mid-America's shares fell 4.9 percent. Twitter rose 6.8 percent after the New York Times reported the company was in talks to bring its app to the Apple TV platform.

Source: Institute of Trading and Portfolio Management