Trading Economics: The number of Americans filing for unemployment benefits decreased by 4,000 to 262,000 in the week ended August 13th 2016. It is the lowest figure in four weeks and better than market expectations of 265,000. It marks the 76th consecutive week initial claims are below 300,000, the longest streak since 1970 and signalling the labour market strength.

“This was a modestly more favorable outcome than expectations and a pretty solid level for the claims data; but it does look like conditions in the labor market have cooled relative to the more upbeat readings reported a month or so ago,” J.P. Morgan Chase economist Daniel Silver said in a note to clients.

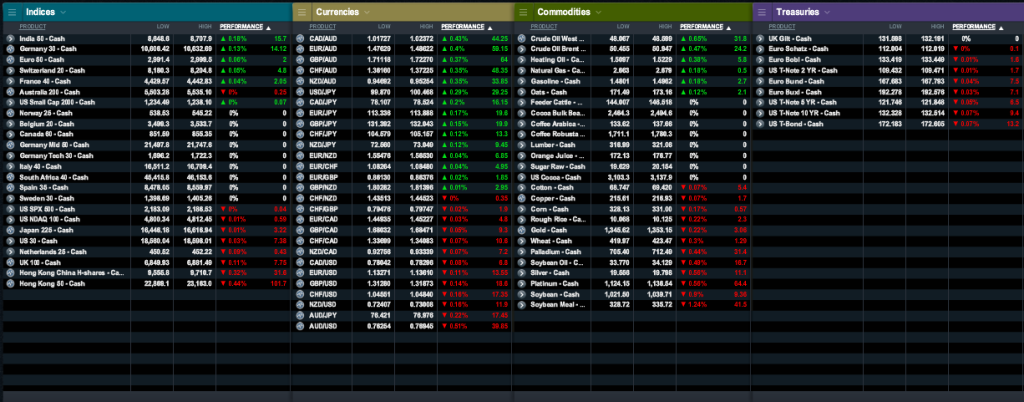

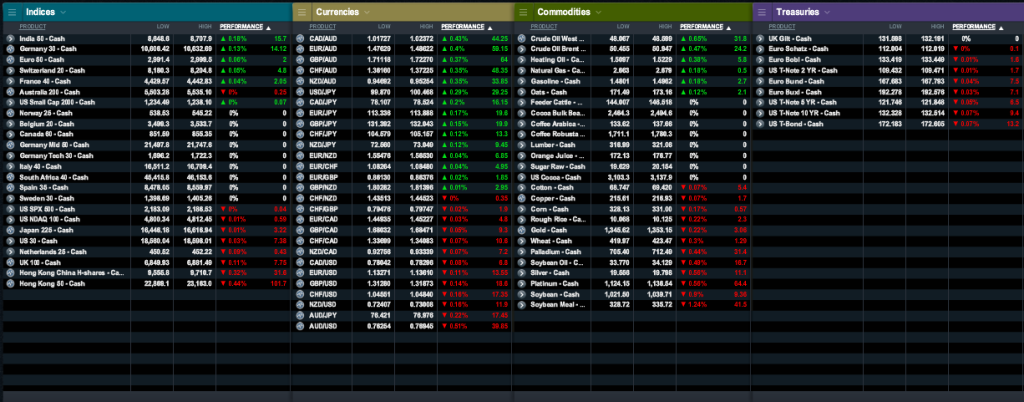

Market Snap

Market Opening Wrap

In Asian Equity Markets

Market Opening Wrap

In Asian Equity Markets stocks retreated on Friday and the dollar edged up from a near eight-week low after some Federal Reserve officials reiterated the case for raising interest rates in coming months. MSCI's broadest index of Asia-Pacific stocks outside Japan pulled back 0.6 percent. Japan's Nikkei erased earlier gains to trade 0.1 percent lower, set for a weekly loss of 2.6 percent. South Korea's Kospi also surrendered earlier increases to slip 0.1 percent, on track for a 0.1 percent weekly gain. Australian stocks added 0.2 percent, heading for a 0.2 percent decline for the week. China's CSI 300 index and the Shanghai Composite fell 0.2 percent, but were still up 1.9 percent and 1.6 percent for the week, respectively.

In Currency Markets the dollar wallowed close to eight-week lows against the euro in Asian trade on Friday, poised for weekly losses, after minutes of the U.S. Federal Reserve's July meeting revealed central bank policymakers were in no hurry to hike rates. The euro edged down 0.1 percent to $1.1348, within sight of its overnight high of $1.1366, its loftiest peak since June 24. It was on track to gain 1.7 percent for the week. The dollar clawed back some losses against its Japanese counterpart, rising 0.4 percent to 100.22 yen, though it was still down 1.1 percent for the week. The dollar index was down 1.5 percent for the week, though it edged up 0.1 percent on the day to 94.245.

In Commodities Markets Brent crude oil prices fell in early Asian trading hours on Friday, but remained near two-month highs with Brent still holding above $50 per barrel in a bull-run that has lifted the market by over 20 percent since early August. International benchmark Brent crude oil futures were trading at $50.80 per barrel, down 9 cents from their last close. U.S. West Texas Intermediate crude futures, were at $48.28 a barrel, up 6 cents. Spot gold was down 0.4 percent at $1,346.56 an ounce. Silver was down 0.5 percent at $19.63 an ounce. Platinum fell 0.4 percent at $1,120. Palladium was down 1 percent at $705.47, after hitting an one-week high of $717.70 Thursday.

In US Equity Markets stocks ended up slightly on Thursday as Brent oil's rise above $50 a barrel boosted energy shares and an upbeat outlook lifted Wal-Mart to a 14-month high. The Dow Jones industrial average gained 0.13 percent, to 18,597.7, the S&P 500 added 0.22 percent, to 2,187.02 and the Nasdaq Composite rose 0.22 percent, to 5,240.15. Cisco shares fell 0.8 percent after the network equipment provider said it would cut 5,500 jobs and gave a disappointing forecast. NetApp jumped 17.4 percent after its quarterly results beat expectations. Wal-Mart rose 1.9 percent to end after the retailer reported a better-than-expected quarterly profit and raised its fiscal-year outlook.

In Bond Markets U.S. Treasury yields fell on Thursday on bets the Federal Reserve is in no hurry to raise interest rates with domestic inflation stuck below its 2 percent goal and uncertainty about global risks to economic growth at home. Benchmark 10-year Treasury notes were up 8/32 in price to yield 1.534 percent, down 1 basis point from Wednesday, while the 30-year bond was up 10/32 in price for a yield of 2.258 percent, down 1.5 basis points.

Source: Institute of Trading and Portfolio Management