News Event

News Event

From Trading Economics: Sales of new single-family houses in the United States fell 7.6 percent to a seasonally adjusted annual rate of 609,000 in August of 2016, better than market expectations of an 8.8 percent decline. Figures for the previous month were revised up by 5,000 to 659,000, the highest since 2007. New Home Sales in the United States averaged 652.45 Thousand from 1963 until 2016, reaching an all time high of 1389 Thousand in July of 2005 and a record low of 270 Thousand in February of 2011. New Home Sales in the United States is reported by the U.S. Census Bureau.

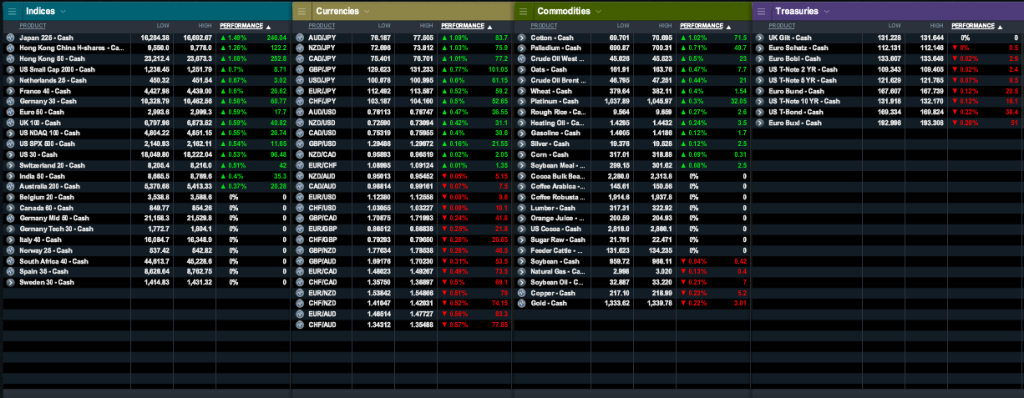

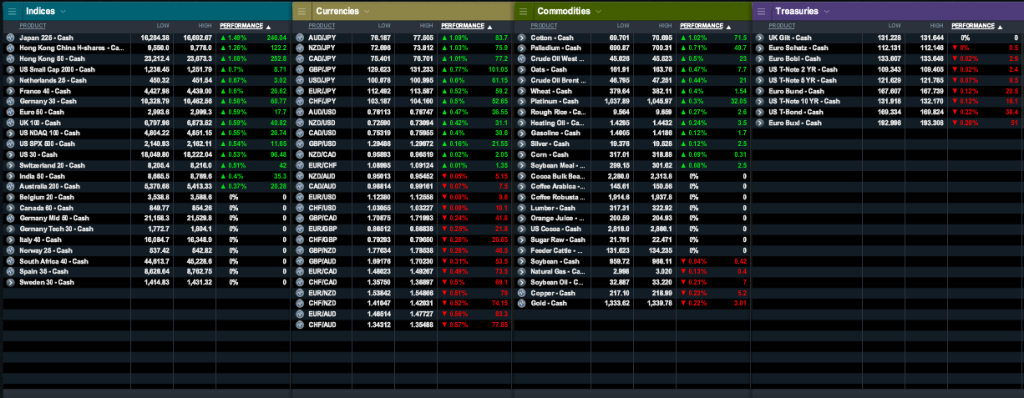

Market Snap

Market Opening Wrap

In Asian Equity Markets

Market Opening Wrap

In Asian Equity Markets Japanese stocks were down on Tuesday morning, but were off 7-1/2-week lows hit in early deals amid some volatility as Hillary Clinton and Donald Trump wound up their first U.S. presidential debate. At the midday break, the Nikkei was down 0.3 percent at 16,490.41, recovering from an early morning low of 16,285.41, the weakest level since Aug. 5. The broader Topix shed 0.5 percent to 1,329.34 and the JPX-Nikkei Index 400 declined 0.6 percent to 11,910.14. As early risk aversion faded, MSCI's broadest index of Asia-Pacific stocks outside Japan recouped early losses to rise 0.5 percent. The Shanghai Composite Index rose 0.05 percent, while Hong Kong's Hang Seng Index gained 0.74 percent.

In Currency Markets the Mexican peso rose in Asian trade on Tuesday, buoyed by the view that U.S. presidential candidate Hillary Clinton did better than her rival Donald Trump in a closely-watched television debate. The Mexican peso gained about 2 percent on the day to 19.488 to the dollar, putting it on track for its best daily performance since February. Against the yen, the dollar was last trading at 100.73 yen, up 0.4 percent on the day. The greenback had fell to as low as 100.085 yen earlier on Tuesday, its lowest level since late August, as caution gripped the market ahead of the U.S. presidential debate. Against a basket of currencies, the dollar was a fraction firmer at 96.360 and the euro was steady at $1.1242.

In Commodities Markets crude futures fell in Asian trade on Tuesday as investors took profits after prices climbed more than 3 percent in the previous session. Brent crude futures fell 15 cents to $47.20 a barrel after closing up $1.46 in the previous session. U.S. West Texas Intermediate crude fell 6 cents to $45.87 a barrel, after rising $1.45 in the previous session. The OPEC and other oil producers led by Russia are meeting informally on the sidelines of the International Energy Forum in Algeria from Sept. 26-28. Spot gold was down 0.2 percent at $1,335.46 an ounce. Silver fell 0.2 percent to $19.39 an ounce. Platinum was down 0.1 percent at $1,034.75, while palladium fell 0.2 percent to $691.72 per ounce.

In US Equity Markets stocks fell on Monday as Deutsche Bank weighed on financials and investors hunkered down for the first debate between U.S. presidential candidates Hillary Clinton and Donald Trump. The Dow Jones industrial average fell 0.91 percent to end at 18,094.83 points and the S&P 500 lost 0.86 percent to 2,146.1. The Nasdaq Composite lost 0.91 percent to finish at 5,257.49. The S&P financial index fell 1.5 percent, with JPMorgan's 2.19 percent decline and Bank of America Corp's 2.77 percent slide weighing most. Pfizer Inc fell 1.81 percent after it decided against splitting into two. The CBOE Market Volatility index rose 17.9 percent, clocking its biggest percentage gain in two weeks.

In Bond Markets U.S. Treasury debt prices climbed on Monday as investors sought the safety of government bonds while global equities fell, led by financials on news on Deutsche Bank that dragged its shares to record lows. U.S. benchmark 10-year Treasury notes were last up 7/32 in price, yielding 1.589 percent, down from 1.615 percent late on Friday. U.S. 30-year bond prices rose 8/32 in price, yielding 2.325 percent, down from 2.339 percent on Friday.

Source: Institute of Trading and Portfolio Management