Japan's GDP unexpectedly showed no growth in the June quarter of 2016, following a 0.5 percent expansion in the first quarter and market expectations of a 0.2 percent growth, preliminary estimates showed. Private consumption and government spending slowed sharply while capital expenditure and exports declined. On an annualised basis, the economy advanced 0.2 percent, slowing markedly from an upwardly revised 2.0 percent expansion in the three months to March and below market estimates of a 0.7 percent growth.

"There's been quite a lot of strength in the yen, economic uncertainty and a bounce in oil prices, so its not surprising that [Japan] is barely growing. That's been the average growth rate for the past five years," Mark Jolley, equity strategist at CCB International Securities, told CNBC.

"As long as Japan is growing between zero and one percent, that's a fabulous result. From the equity market's point of view, as long as you have broad stability in the economy, that will keep people reasonably comfortable with Japanese equities, so this [Monday's GDP data] is as good as you can expect," he added.

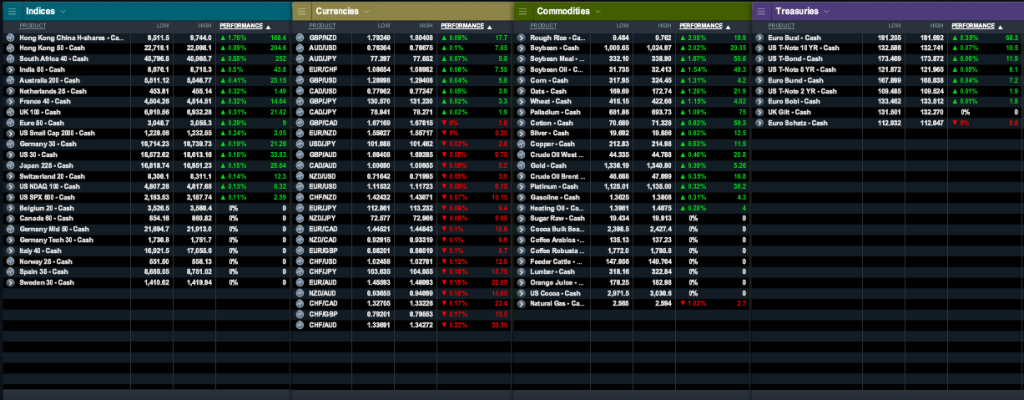

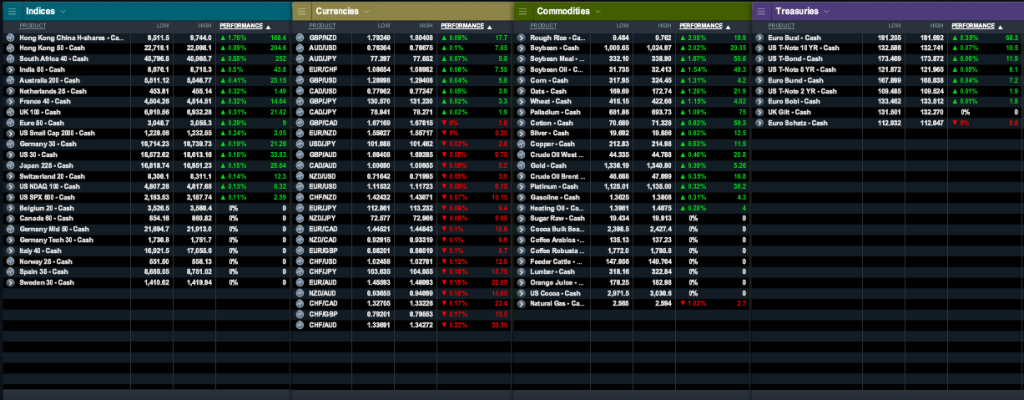

Market Snapshot

Market Opening Wrap

In Asian Equity Markets

Market Opening Wrap

In Asian Equity Markets Nikkei share index slipped on Monday as the yen stayed strong and data showed economic growth stalled in the second quarter, souring investor sentiment. The Nikkei fell 0.2 percent to 16,884.76 points by midmorning, after rising 4.1 percent last week. Exporters were mixed, with Toyota Motor Corp falling 0.2 percent, Honda Motor Co rising 0.5 percent and Panasonic Corp dropping 0.8 percent. Sharp Corp soared as much as 17 percent after the company said that Taiwan's Foxconn had completed its takeover. The broader Topix dropped 0.1 percent to 1,321.42 and the JPX-Nikkei Index 400 declined 0.2 percent to 11,886.08.

In Currency Markets the US dollar was on the defensive on Monday, pressured by downbeat U.S. data that tempered expectations of a near-term interest rate hike by the Federal Reserve. The greenback was little changed at 101.340 yen after losing 0.6 percent on Friday, when the U.S. indicators were released. The euro was steady at $1.1156 after edging up 0.2 percent on Friday. The dollar index was effectively unchanged at 95.767 after going to as low as 95.254 on Friday, its lowest since August 3. The Australian dollar was flat at $0.7646. The Aussie had risen to a 3-month high of $0.7760 last week, due to the country's relatively higher yields, but it was nudged off the peak in response to weaker than expected Chinese indicators.

In Commodities Markets oil prices edged up early on Monday and have risen more than 10 percent since the start of the month as speculation intensifies about potential producer action to support prices in an oversupplied market. International Brent crude oil futures were trading at $47.13 per barrel, up 16 cents from their last settlement, and over 10 percent above the last close in July. U.S. West Texas Intermediate (WTI) crude futures were at $44.67 a barrel, up 18 cents from their last close. After falling sharply from over 1,600 in 2014, before the price rout started, to a low of just 316 in late May, the U.S. oil rig count has steadily risen since then as U.S. producers have adjusted to lower prices.

In US Equity Markets the Dow and S&P 500 eased from record highs on Friday as tepid data dampened investor confidence in the economy's expansion, while the Nasdaq inched up to a second straight record high close. Among the S&P 500's biggest drags was Dow Chemical, which fell 2.4 percent to $52.33, while DuPont declined 1.9 percent to $67.66, a day after European Union regulators opened a full investigation of their $130 billion merger agreement. The S&P materials index, down 1.2 percent, led sector declines in the benchmark index. Giving the Nasdaq its biggest boost on Friday, shares of chipmaker Nvidia gained 5.6 percent to $63.04, a day after it reported its fastest quarterly sales growth in nearly five years.

In Bond Markets Japanese government bond prices slipped on Monday, after a report highlighted the side effects of negative interest rates and clouded the outlook for the Bank of Japan's easy monetary policy. The benchmark 10-year JGB yield was up 2.5 basis points at minus 0.085 percent, while the 20-year yield edged up half a basis point to 0.250 percent. JGBs were unfazed by Monday's data which showed Japan's economy grew a modest 0.2 percent in the second quarter, compared with a median forecast for a 0.7 percent expansion.

Source: Institute of Trading and Portfolio Management