News Event:

News Event:

From Trading Economics: Business confidence in Netherlands rose to 3.4 in September of 2016 from 1.2 in August, mainly driven by an increase in the index of semi-finished goods (107.5 from 106.5 in the preceding month) and investment goods (108.6 from 106.9). In contrast, the index of consumption goods fell to 92.9 from 93.2. In September 2015, manufacturing confidence stood at 3.8. Business Confidence in Netherlands averaged 0.34 from 1985 until 2016, reaching an all-time high of 9.40 in January of 2008 and a record low of -23.50 in February of 2009. Business Confidence in Netherlands is reported by the Statistics Netherlands.

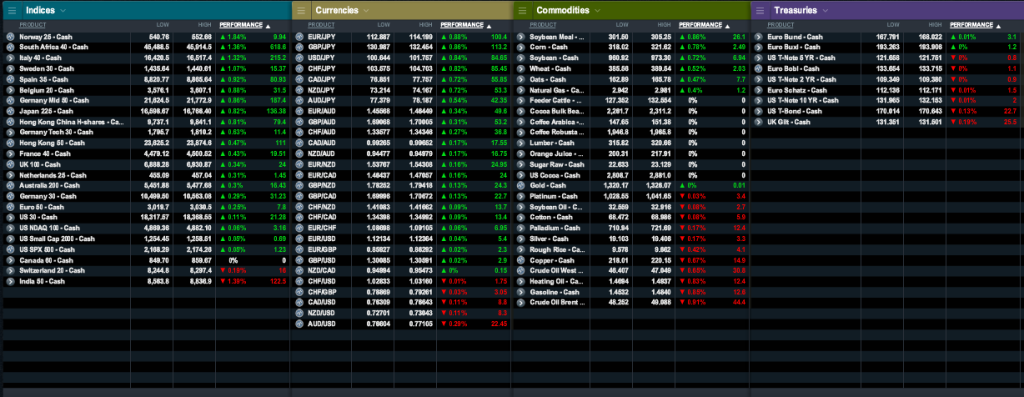

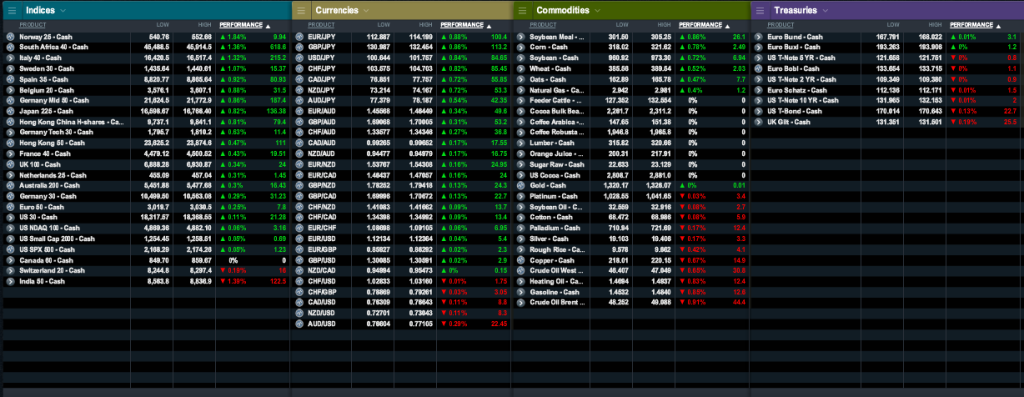

Market Snap

Market Opening Wrap

In Asian Equity Markets

Market Opening Wrap

In Asian Equity Markets, oil stocks pulled regional stock markets higher on Thursday after OPEC members agreed to curb output in a surprise deal, though investors were wary of chasing markets higher as the U.S. presidential election neared. MSCI's broadest index of Asia-Pacific stocks outside Japan was up 0.9 percent by mid-morning, thanks to a bounce in energy stocks. Japan's Nikkei climbed 1.5 percent, after losing 1.3 percent the previous day. In Hong Kong, the benchmark index was up 0.5 percent with energy-related stocks the biggest gainers. The broader Topix rose 0.9 percent to 1,343.16 and the JPX-Nikkei Index 400 added 1 percent to 12.027.85. The Australian stocks gained 0.91 percent.

In Currency Markets commodity-linked currencies held firm on Thursday after OPEC agreed to cut oil output in the first such deal since 2008, boosting oil prices while a broad gain in risk assets dented the yen. The Norwegian crown was a clear winner, hitting a near five-month high of 8.0222 to the dollar and 14-month high of 9.0085 per euro. The Australian dollar also hit a three-week high of $0.7696. The Canadian dollar climbed to C$1.3054 versus the greenback after having risen 0.9 percent on Wednesday. The dollar rose 0.7 percent to 101.35 yen, extending its rebound from one-month low of 100.085 touched on Tuesday. The euro was little changed at $1.1222, recovering from Wednesday's low of $1.1182.

In Commodities Markets oil futures retreated on Thursday as the market grew more sceptical on how OPEC would implement a plan to curb oil output a day after the group agreed to limit production. Brent crude had fallen 26 cents to $48.43 a barrel, after earlier climbing to a high of $49.09 when the market opened, its highest since Sept. 9. Brent settled up 5.9 percent, in the previous session. WTI crude fell 6 cents to $46.99 a barrel, after first hitting $47.47, its highest since Sept. 8. U.S. oil rose $2.38, or 5.3 percent, on Wednesday. U.S. crude stocks fell 1.9 million barrels to 502.7 million barrels in the week to Sept. 23, against analyst expectations for a 3 million-barrel increase. Spot gold had risen 0.3 percent to $1,325 an ounce.

In US Equity Markets stocks ended higher on Wednesday after an OPEC agreement to limit crude output fueled a rally in oil and more than offset nervousness about a tight race for the U.S. presidency. The Dow Jones industrial average rose 0.61 percent to end at 18,339.24 and the S&P 500 gained 0.53 percent to 2,171.37. The Nasdaq Composite added 0.24 percent to 5,318.55. Seven of the 11 major S&P sectors were higher. Telecom services fell 1.04 percent, the steepest of the decliners. Nike lost 3.78 percent after the shoemaker's orders missed analysts' estimates for the third time in a row. Paychex fell 4.60 percent after the payroll processor lowered its full-year profit forecast.

In Bond Markets U.S. long-dated Treasury debt yields edged higher on Wednesday, boosted by a report that OPEC has reached a deal to limit oil production, with the agreement to be implemented in November. In afternoon trading, U.S. benchmark 10-year Treasury notes were down 1/32 in price for a yield of 1.561, compared with 1.556 percent late on Tuesday. U.S. 30-year bonds fell 3/32 in price, yielding 2.282 percent, up from Monday's 2.278 percent.

Source: Institute of Trading and Portfolio Management