News Event

News Event

From Trading Economics: Consumer prices in Japan dropped by 0.5 percent year-on-year in August of 2016, following a 0.4 percent fall in the previous three months and in line with market expectations. It was the sixth straight month of decline and the fastest fall since April 2013, as the cost of housing and transport fell further while prices of food rose at a slower pace. Core consumer prices fell 0.5 percent from a year earlier, the same pace as in July. It was the sixth consecutive month of fall and the fastest drop since March 2013 while market expected a 0.4 percent decrease. The so-called core-core consumer prices, which excludes food and energy prices rose 0.2 percent year-on-year, compared to a 0.3 percent rise in June. On a monthly basis, consumer prices remained unchanged, following a 0.2 percent decline in the previous two months

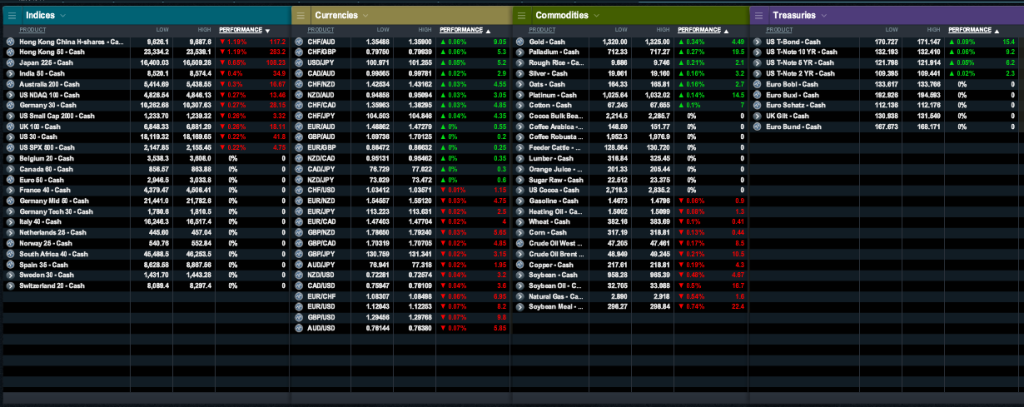

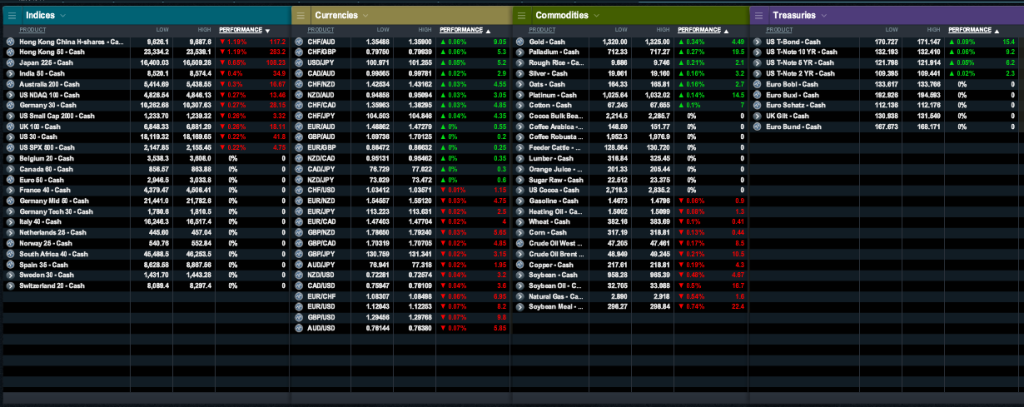

Market Snap

Market Closing Wrap

In European Equity Markets

Market Closing Wrap

In European Equity Markets stocks ended flat on Thursday as losses among drugmakers offset energy share gains following an OPEC deal to cut output, while Commerzbank slid after the German lender froze dividend payments. The pan-European STOXX 600 ended flat after rising as much as 1.1 percent earlier in the session, dragged back down by weakness in drugmakers and travel stocks. Novo Nordisk fell 3.5 percent after the world's largest insulin maker said it was cutting jobs as a part of a plan to reduce costs. Shares in Lufthansa fell 2.7 percent, hurt by concerns that its plans to boost its low-cost brand would neither lower costs nor head off larger rivals. The European oil and gas index rose 4.3 percent, making its best day in seven months.

In Currency Markets the U.S. dollar hit an eight-day high against the yen on Thursday on reduced appetite for the safe-haven currency a day after OPEC agreed to cut oil output while easing concerns surrounding the European banking sector helped the euro gain. The dollar was last up 0.92 percent against the yen at 101.58 yen after hitting an eight-day high of 101.84 yen. The euro was last up 0.12 percent against the U.S. dollar at $1.1228. The Australian dollar remained weaker, with Aussie down 0.30 percent at $0.7668, after hitting a three-week high of $0.7711 overnight, while Kiwi held steady at $0.7279. Sterling was down 0.41 percent to $1.2966. The dollar index was last up 0.06 percent at 95.494.

In Commodities Markets oil prices rose nearly 3 percent on Thursday, extending their rally on optimism over OPEC's first output cut plan in eight years, despite some analysts' doubts that the reduction would be enough to rebalance a heavily over-supplied market. Brent crude futures were up 2.2 percent, at $49.75. Brent hit a session peak at $49.81, the highest since Sept. 9, after falling to $47.99 earlier. U.S. West Texas Intermediate crude futures rose 2.6 percent, to $48.25. WTI hit a one-month high of $48.32, after a session low at $46.60. Spot gold was unchanged at $1,321.23 an ounce. Silver fell 0.3 percent to $19.12 an ounce, while platinum rose 0.4 percent to $1,029.60 and palladium gained 1.4 percent to $718.90.

In US Equity Markets stocks were lower in choppy trading late Thursday morning, pulled lower by Apple and healthcare stocks. The Dow Jones Industrial Average was down 0.22 percent, at 18,298.39. The S&P 500 was down 0.22 percent, at 2,166.59 and the Nasdaq Composite was down 0.43 percent, at 5,295.75. Five of the 11 major S&P indexes were lower, with utilities falling the most by 1.1 percent. The S&P healthcare index fell 0.7 percent, marking the second straight day of decline as shares of Merck and Johnson & Johnson booked losses. Apple fell 1.23 percent after Barclays cut its price target. eBay rose 3 percent after Deutsche Bank upgraded the e-commerce platform's rating to "buy" and raised its price target.

In Bond Markets U.S. Treasury debt yields edged higher for a second straight session on Thursday, as risk appetite improved with oil and global stocks mostly posting gains after news on Wednesday OPEC would cut crude supply. In mid-morning trading, U.S. benchmark 10-year Treasury notes were down 6/32 in price for a yield of 1.589 percent, up from 1.567 percent late on Wednesday. U.S. 30-year bonds fell 16/32 in price, yielding 2.312 percent, up from Wednesday's 2.288 percent.

Source: Institute of Trading and Portfolio Management