Fundamental Outlook: GBP/USD

During today's London session BoE's Shafik reiterated the possibility of further stimulus measures which initially resulting in GBP weakness however this has since been pared.

Risk sentiment has once again improved following reports of Deutsche Bank selling Abbey Life for $1.2 bln, easing concerns over Deutsche Bank's lawsuit in the US. This has also resulted in EUR strength with EURUSD breaking back above 1.1200.

Coming up in today's New York session will be comments from Fed Chair Yellen as she testifies before the committee on Financial Services, shortly followed by comments from ECB President Draghi and this weeks Crude Oil Inventories.

In today’s session we expect the strongest currency to be USD as USD remains the strongest currency from a fundamental perspective.

The weakest currency is expected to be GBP as fundamentally GBP remains weak due to the potential for further easing which was reiterated today by BoE's Shafik.

The GBPUSD pair is currently priced at 1.3015.

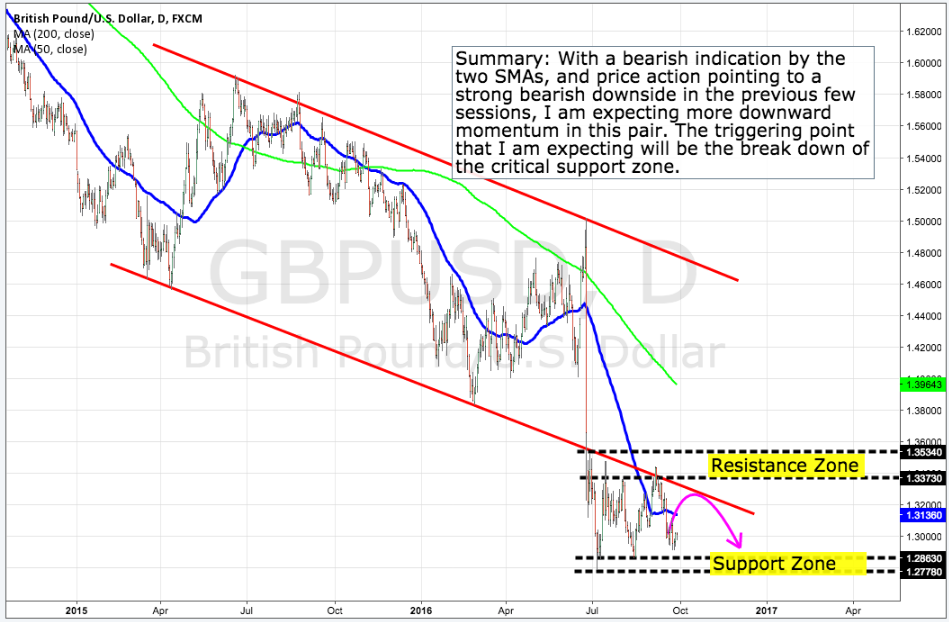

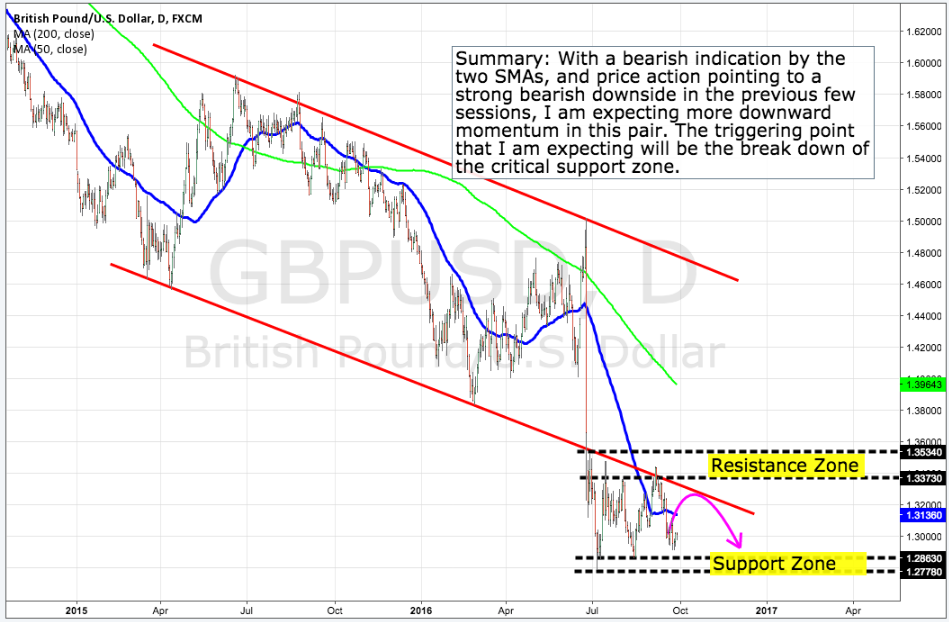

There are several levels including the current price level which can be considered for selling opportunities:

The price levels below could be used to sell from as price retraces into them:

1.3084, 1.3166, 1.3330

The price level below could be used to sell from as price breaks out below:

1.2850

Source: Jarratt Davis

Technical Outlook: GBP/USD

Overview of Currencies

Overview of Currencies

USD: The Federal Reserve are most likely to leave their current policy unchanged at their next meeting due to its close proximity to the US elections and the fact that the Fed's November meeting has no scheduled press conference which would be necessary for the Fed to provide further in depth information following such a decision. Given 14 of 17 Fed members expect at least a hike in 2016, there is a strong possibility of the Fed increasing rates by 25 basis points at their December meeting. This gives the USD currency an overall bullish tone for the next 3 months.

EUR: The ECB are most likely to leave their policy unchanged at their next meeting because they have already cut their main rates heavily over recent years and they are at what many experts consider to be an ultimate low. If the bank did conduct a policy change within the next 3 months then the most likely move is an increase in its QE programme, because it is still battling low inflation alongside low interest rates, so more powerful action could be needed. This gives the EUR currency an overall dovish bias over the next 3 months.

GBP: The BoE are most likely to ease policy within the next 3 months with the BoE's November meeting seen as the most likely meeting for further cuts providing "their August forecasts are met". The UK economy however has been much more resilient following the 'Brexit' than many had expected, and therefore should UK data continue to surprise, expectations for further BoE easing may be pushed further back and shift expectations towards the BoE remaining on hold. Overall however given the BoE's latest comments and expectations for further cuts potentially as soon as November, we maintain our bearish fundamental bias on GBP.

AUD: There is a strong possibility that the RBA will ease policy again during 2016 as many economist believe the door for further easing remains open due to continued low inflation in Australia. As such inflation data for Q3 will be key in regards to future policy expectations, Q3 CPI is not released until October and therefore although the RBA will likely leave policy unchanged at their September meeting, further easing in later meetings remains a strong possibility especially if Q3 CPI disappoints. This therefore maintains our bearish bias for AUD.

NZD: There is a strong possibility that the RBNZ could ease policy further at their November meeting due to continued concerns over inflation. Q3 inflation due in October will therefore be highly influential to rate cut expectations with the OIS market currently only pricing a 20% chance of a rate cut as of September 27. Due to the possibility of further rate cuts by the RBNZ we maintain a bearish bias for NZD.

CAD: The BoC are most likely to leave monetary policy unchanged at their next meeting as Canadian inflation is within the BoC’s target range of 1-3% with the economy also supported by accommodative fiscal measures. If the BoC did conduct a policy change within the next 3 months it would likely be a rate cut based on concerns over Canada’s competitiveness since CAD’s appreciation throughout the year and increasing concerns over inflation. Although this gives CAD a slightly bearish fundamental bias, with most central banks currently in easing cycles CAD has a comparatively neutral bias.

JPY: The BoJ will most likely need to ease policy further in the near future as the increases made to its ETF purchases and USD lending programmes will likely be insufficient in helping inflation reach its target of 2%. Furthermore Kuroda’s pledge to "conduct a comprehensive assessment" of economic and price developments when the BoJ next meet highlights that further easing is still on the table. With further easing by the BoJ likely we continue to maintain a fundamentally bearish view on JPY, however due to its status as a safe haven currency JPY will likely strengthen in times of risk off sentiment.

CHF: The SNB are most likely to leave their policy unchanged at their next meeting as interest rates in Switzerland already remain at a record low of -0.75%. If the SNB were to change policy in the next 3 months it would likely be a rate cut as inflation continues to remain far below the SNB’s target. This gives CHF an overall bearish tone.

Source: Jarratt Davis