Consumer Sentiment Index for Australia rose 2.0 percent to 101 in August of 2016, compared to a 3.0 percent drop in July. Expectations over economic conditions over the next 12 months increased by 3.5 percent, following a sharp decline in a month earlier. The outlook over the next 5 years dipped a slight 0.7 percent. The measure of whether this was a good time to buy major household items was up by 1.6 percent.

Bill Evans, chief economist at Westpac, wasn’t surprised by the modest increase, noting that while sentiment tends to lift following a rate cut, the fact it was largely expected, and not passed on in full to the vast majority of mortgage holders, likely contributed to a muted gain.

“(In May) the index lifted by an impressive 8.5% from 95.1 to 103.2. That was an exceptionally large positive response and much stronger than the average rise following rate cuts historically. That can be explained by a number of factors,” he said.

“Firstly, there was a larger surprise element to the May decision with, arguably, significantly less intense media speculation than we saw in August. Secondly, the standard variable mortgage rate offered by most banks was reduced by the full 0.25%, whereas in August the four major banks only reduced variable rates by 0.10-0.14%.

“Finally, the index was coming from a significantly lower starting point in May (95.1) than in August (99.1),” he added.

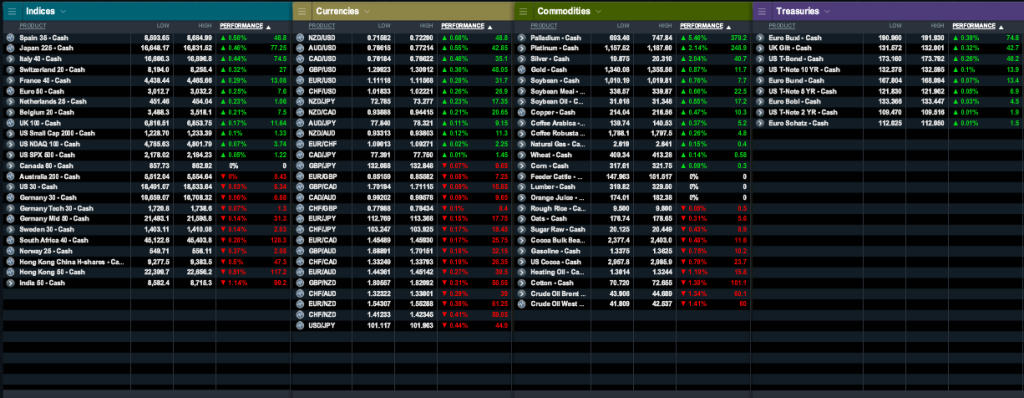

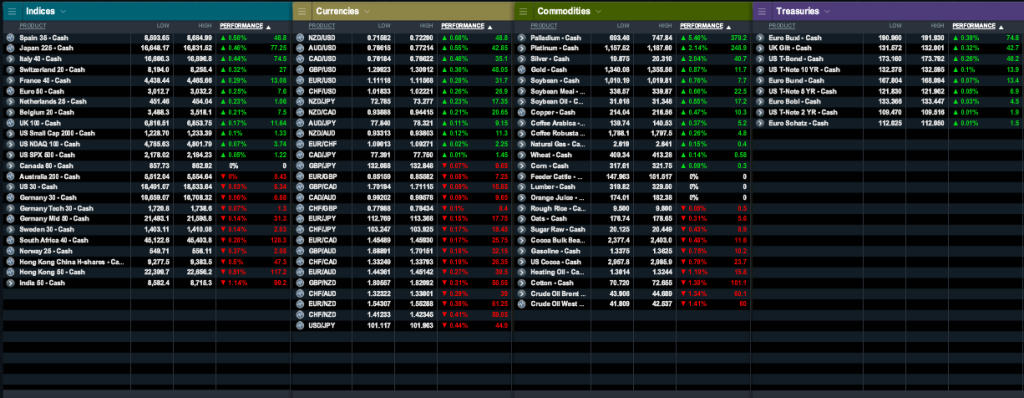

Market Snapshot

Equity Markets: Top performer: Spain. Worst performer: Inda

Opening wrap: The S&P 500 inched up 0.04 percent to 2,181.74 and the Nasdaq Composite added 0.24 percent to end at 5,225.48 points. Six of the 10 major S&P 500 indexes rose, led by a 0.24 percent increase in the consumer staples index. The Nikkei ended the morning session down 0.3 percent at 16,716.58. MSCI's broadest index of Asia-Pacific stocks excluding Japan rose 0.35 percent to the highest level since August 2015. Hong Kong's Hang Seng index rose 0.6 percent, hovering close to its highest level since November. China's CSI 300 index and the Shanghai Composite were little changed. South Korean stocks were also flat, after earlier touching a nine-month high. Taiwanese stocks climbed to the highest in 13 months on Wednesday, and were last trading flat.

Currency Markets : Top performer: NZD/USD. Worst performer: USD/JPY

Opening wrap: The dollar was down 0.6 percent at 101.325 yen, having gone as high as 102.660 on Monday on the strong nonfarm payrolls data. The euro rose 0.3 percent to $1.1148, touching a 5-day high of $1.1149. Sterling was up 0.4 percent at $1.3060, recovering from the $1.2956 hit on Tuesday, its lowest level since July 11. The Australian dollar advanced to a 3-month peak of $0.7703, buoyed this week by Australia's relatively high yields and investor appetite for risk. The dollar index was down 0.4 percent at 95.799.

Commodities Markets: Top performer: Palladium. Worst performer: Crude Oil WTI

Opening wrap: U.S. West Texas Intermediate crude oil futures were trading at $42.69 per barrel, down 9 cents from their last settlement. International Brent crude futures were at $44.93 per barrel, down 5 cents. Spot gold increased 0.9 percent to $1,352.77 an ounce. Spot silver was up nearly 2 percent at $20.19 an ounce. Spot palladium rose 7.4 percent to touch a high of $745 an ounce, the highest since June 2015. Platinum rose 2.3 percent to $1,175.85, after rising as high as $1,179.60, its best in over 16 months.

Treasuries: Top performer: Euro Buxi. Worst performer: Euro Schatz

Opening wrap: The benchmark 10-year JGB yield fell 1.5 basis points to minus 0.100 percent. U.S. Treasury prices rose on Tuesday after a weak report on U.S. productivity and a reverse auction in which the Bank of England failed to meet its long-dated bond purchasing target boosted the appetite for U.S. government debt. Benchmark 10-year Treasury notes rose 11/32 in price to yield 1.547 percent. The 30-year bond gained 29/32 in price to yield 2.259 percent.